Owners of incomeproducing properties are eligible for significant taxation benefits and yet some of the perks continue to fly under the radar.

Research shows 80 per cent of property investors are failing to take full advantage of property depreciation and are missing out on thousands of dollars in their pockets. In the 2017/2018 financial year, BMT Tax Depreciation found residential property investors an average first year deduction of $8,212. One of the reasons property depreciation is often missed is because it's a non-cash deduction. This means an investor doesn't need to spend money to be eligible to claim it.

AS A BUILDING GETS OLDER, ITEMS WEAR OUT – THEY DEPRECIATE

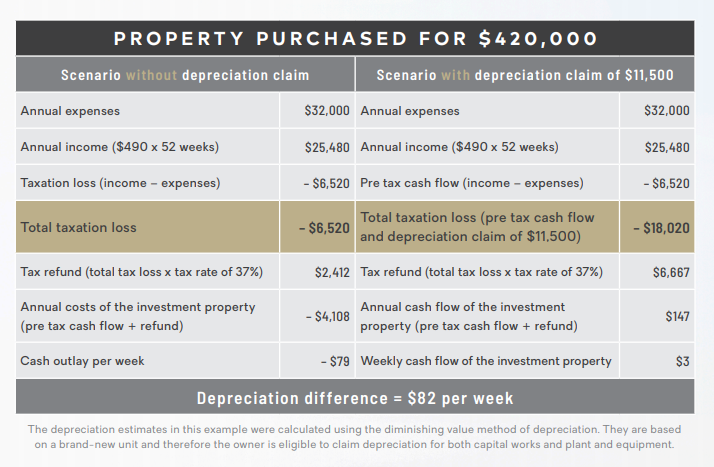

The Australian Taxation Office allows property owners to claim this depreciation as a tax deduction. Depreciation falls into two categories: • A capital works allowance (division 43) for the structure of the building and any fixed assets (such as walls, floors, roofs, tiling and cabinetry) • Plant and equipment deductions* (division 40) for eligible removable and mechanical assets (such as ovens, carpets, curtains and blinds and hot water systems). The following example shows how depreciation claims are calculated, the difference these claims can make and how claiming these deductions helps improve your cash flow.

DEPRECIATION: AN INVESTOR PROFILE

An investor purchased a brand-new two bedroom unit for $420,000. The property is rented for $490 per week or a total income of $25,480 per annum. The estimated expenses for the property including interest, rates and management fees total $32,000 per annum. A new two bedroom unit typically will depreciate by around $11,500 in the first full financial year. The following scenario shows the investor's cash flow with and without depreciation.

In the above example, the investor uses property depreciation to go from a negative cash flow scenario, paying $79 per week, to a positive cash flow scenario. By claiming depreciation this investor will save $4,255 for the year.

* Under new legislation outlined in the Treasury Laws Amendment (Housing Tax Integrity) Bill 2017 passed by Parliament on 15th November 2017, investors who exchange contracts on a second-hand residential property after 7:30pm on 9th May 2017 will no longer be able to claim depreciation on previously used plant and equipment assets. Investors can claim deductions on plant and equipment assets they purchase and directly incur the expense for. Investors who purchased prior to this date and those who purchase a brand-new property will still be able to claim depreciation as they were previously.

ABOUT THE CONTRIBUTOR

Article provided by BMT Tax Depreciation. Bradley Beer (B. Con. Mgt, AAIQS, MRICS, AVAA) is the Chief Executive Officer of BMT Tax Depreciation. Please contact 1300 728 726 or visit http://www.bmtqs.com.au for an Australia-wide service.