Every property owner wants a secure investment and reliable tenants. But not everything goes to plan. And, some events can't be controlled. What can be controlled is whether you have adequate landlord insurance.

To make sure you are well insured, it is important to be guided through the maze of insurance jargon to find a policy that best protects what is important – your investment and income.

Below, find the answers to common questions asked by landlords, to better arm you with the knowledge needed to choose the most suitable insurance policy for a rental property.

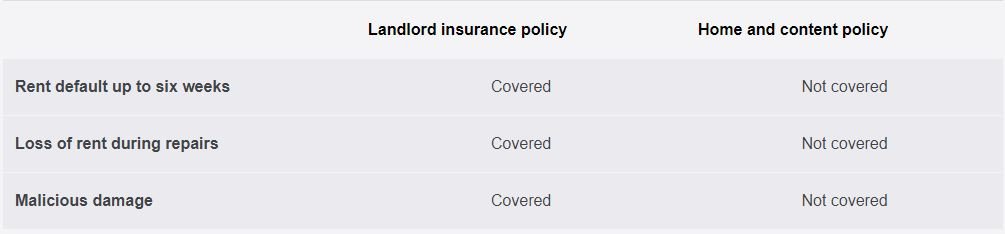

What's the difference between landlord and home and contents insurance?

Home and contents policies typically offer protection for insured events such as fire and storm. However, they often do not cover loss of rent and tenant damage. It is recommended landlords find a specialist insurance policy offering extra protection not covered in standard home and contents policies.

Example: A tenant suffers a job loss and stops paying rent for six weeks before unexpectedly moving out of the property. Upon inspection, it was discovered there was malicious damage to the walls, including two large holes in the hallway.

*This above example and comparison is to be used as a guide only and is a representation of our understanding of general policy features and products. Always read the Product Disclosure Statement and use that information to decide what cover is right for you.

Isn't it one-size-fits-all?

No. The amount of cover and limits offered varies from insurer to insurer. That is why it is important to choose the right landlord insurance policy to protect an investment and reduce the risk of financial and emotional stress. Landlord insurance often offers cover for four main areas: tenant damage and loss of rent, contents insurance, building cover and legal liability. Depending on your property and requirements, you may need a policy that covers ALL four, or only one.

I have a fantastic property manager – shouldn't they be enough protection?

Even the best property manager cannot control or predict a tenant's relationship breakdown or job loss, or an attack by Mother Nature, which is why it is important to invest in extra protection.

Example: A tenant was living in a property for more than five years and built a strong relationship with their property manager. To save money, the property manager decided to cancel the insurance on the property because the tenant had a perfect record of paying rent on time. Unfortunately, two months later, the tenant lost their job and income. The first thing the tenant stopped paying was rent. What was meant to be a cost-saving decision, turned into an expensive mistake.

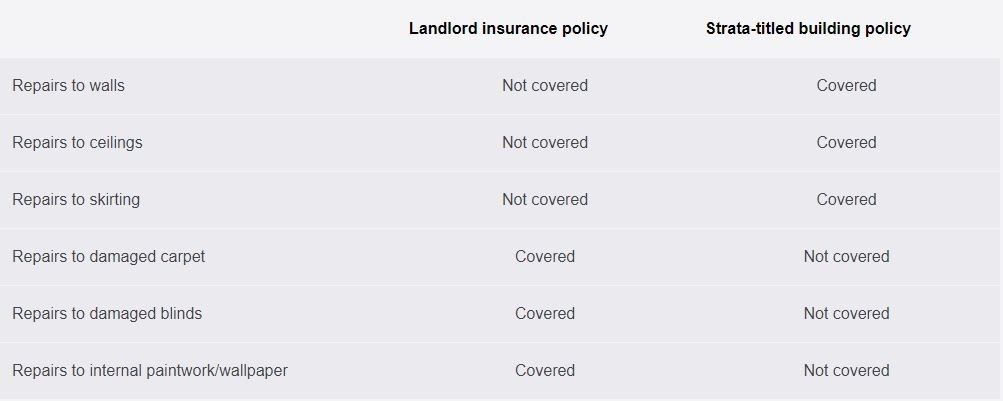

Doesn't the body corporate look after my insurance?

If you own an apartment, villa or unit (a strata titled property), the body corporate may insure the building and common areas in the property – including common hallways, garden and driveway. Because these are covered through the body corporate, many landlords assume they do not need to purchase insurance themselves – this is not the case. The body corporate does not offer protection for unit contents including non-fixed appliances, furniture and electronics, and does not offer protection for loss of rent or legal liability.

Example: During a storm, water entered a landlord's top-level apartment causing damage to the ceilings, walls, carpets and blinds in the lounge and bedroom.

*This above example and comparison is to be used as a guide only and is a representation of our understanding of general policy features and products. Always read the Product Disclosure Statement and use that information to decide what cover is right for you.

*This above example and comparison is to be used as a guide only and is a representation of our understanding of general policy features and products. Always read the Product Disclosure Statement and use that information to decide what cover is right for you.

Isn't the point of a bond to cover loss and damage?

A lot of the time, the bond is just not enough. For example, a tenant may decide not to pay the last four weeks rent because they figure 'that's our bond anyway'. This leaves no money for cleaning and minor repairs. NOTE: Some polices require a bond equivalent to four weeks rental value to have been taken before you are covered for loss of rent and other policy features. Make sure you collect the right amount of bond to ensure your policy is valid when it comes to claim time.

What is an excess?

When you make a claim, you may be required to pay a small amount of the cost (called an excess) and the insurer pays the rest. Not every policy has the same level of excess, and excesses may apply in different situations.

Example: If your investment property is battered in a storm, the cost of repairing damage may be $6,000. If the excess is $400, you would be required to pay this fee while the insurer pays the remainder. The excess can often be reduced from what the insurer pays, meaning you would receive $5,600 for the claim.

Furry friends – are they covered?

People seem to think there is a high risk of animals causing damage in rentals – a key reason landlords say 'no' to pets. However, truth is, more damage is caused by a human than a pet, which is why more and more property owners are extending their tenant-pool to allow those with furry friends. In addition, pet damage can be covered with a landlord insurance policy, offering protection for domestic animals living at the rental property.

What about drug labs?

There is ongoing panic and chatter about the increase of meth contamination in rentals. Insurance cover for the cost of meth contamination clean-up depends on the individual insurer and the specific policies they offer.

Isn't landlord insurance super expensive?

If you think it is too costly, think about how much more expensive it is to pay the cost to completely restore a home in the aftermath of a natural disaster. Premiums can cost just a couple hundred dollars a year. That is peace of mind knowing you have protection for your property, for the approximate cost of a large coffee a day.

I have a tenant on a periodic tenancy – does this affect my insurance?

A periodic tenancy agreement (or month-to-month agreement) may be beneficial as it allows for more flexibility in the tenancy. Many policies require a fixed-term lease to be in place at the time of a loss so make sure you understand your coverage regarding periodic leases and lease continuations.

It is well and good to protect an investment, but will I really be paid out if I make a claim?

Insurance companies are a popular villain. However, when you purchase a policy from an insurer, it is a commitment to assist when things go wrong, and you will be paid out as long as it falls within the policy's terms and conditions. If you do not agree with the outcome of a claim, insurers are required to have a dispute resolution process inline with the General Insurance Code of Practice, which includes the ability for you to escalate your complaint to an external dispute resolution body such as the Australian Financial Complaints Authority. This ensures a fair approach between insurer and client when a claim needs to be made.

Now you have a better understanding about landlord insurance, check out the EBM RentCover range of products to find suitable protection for your property.